The evolution of blockchain lending: the new financial era of Blubber Dao lending

Today’s mainstream defi lending agreements are actually equivalent to pawnshops in the past. With the increase of assets on the chain, the collateral will eventually be included in NFT and token real world assets.

The vast majority of loans in the defi sector are over collateralized. In the case that the borrower does not have any credit score, the lender can only provide credit in an amount lower than the value of the collateral. This is usually described by the loan to value ratio (LTV), which must be less than 100%. In fact, pawnshop is one of the oldest financial institutions, which can be traced back to China in the 5th century.

With the progress of financial knowledge and the emergence of various intermediaries, pawnshops have given way to credit. The main difference between pawnshop business model and credit is that in the latter case, the lender is willing to provide a loan that exceeds the value of the collateral provided (i.e. when the LTV ratio is greater than 100%).

To do so, the lender will conduct its own due diligence based on the available information and assess the risk of default for a particular borrower. However, this work requires (a) an non-transferable identity and (b) more or less reliable data on the credibility of that identity.

The current state of defi is to encrypt pawnshops. Through this kind of agreement, autonomous agreement can promote excessive mortgage lending, thus copying the script of the dark age.

Open finance under the decentralized autonomy of Blubber Dao

Dao, namely decentralized autonomous organization, is a decentralized autonomous organization which is not affected by any centralization subject. It uses open source programs to make decisions, and the organization’s financial records and programs are kept on the blockchain. Dao is undoubtedly a great challenge to many traditional hierarchies and exclusive organizational structures in today’s world. Through “group wisdom”, it can make better collective decision, so that the organization can operate better.

Blubber Dao penetrates Dao’s “open”, “independent” and “autonomous” concepts into defi products such as cross chain asset pledge, lending and asset allocation, aiming to build a Web 3.0 ecosystem that is managed by community autonomy, transparent and decentralized. Blubber uses blockchain technology to return financial and control rights to the public, realizing the common growth of community users’ wealth. The prosperity of defi is obvious to all, and it is difficult for a single form to meet the investment demand.

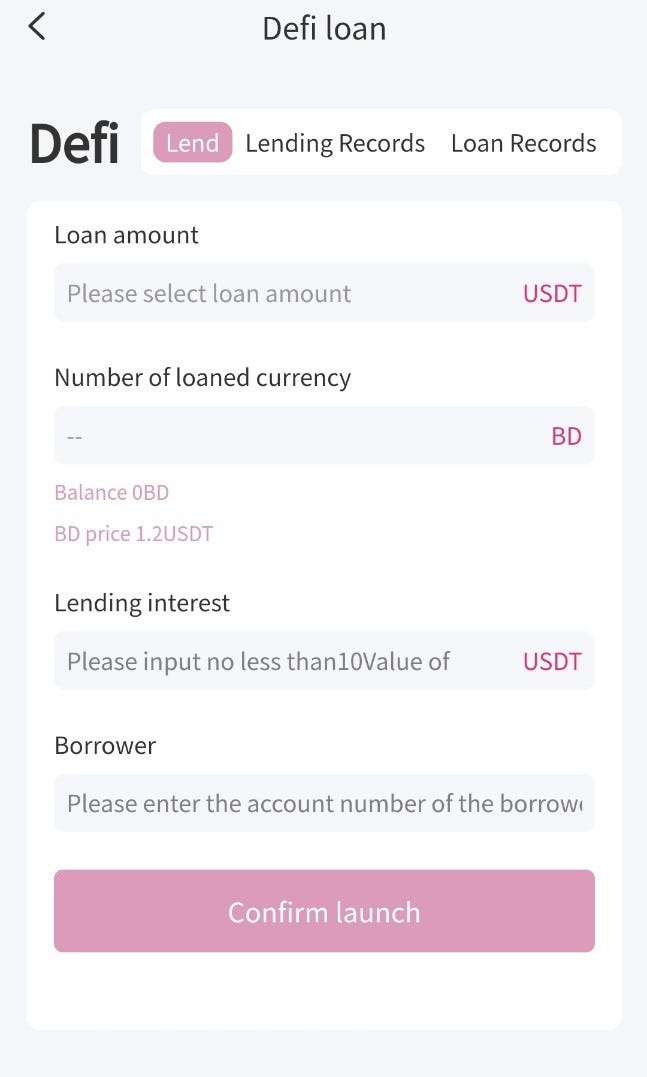

At present, Blubber Dao has launched the DeFi function, and users can use its lending function in the app, as shown in the figure:

In the future, BD will also focus on the development of defi aggregators and related derivatives, further expand BD ecology, and create a richer and more open financial environment for ecological users.